Frequently Asked Questions about the Indemnity Insurance Cover

Have a question? You can access our answers to some of the questions that we have received from SACNASPers on our FAQ page. We have grouped the questions and answers as follows so that it is easier for you to find what you are looking for. If you don't find what you are looking for or have any queries or concerns, please do not hesitate to contact us either via phone or email here.

- All

- General Cover

- Legal Assist

- Criteria

- Retroactive

- Payments & Costs

- Garrun CFP

- Hollard Insurance

- Support

Please click on a question below to show / hide the answer.

If the payment WAS DEDUCTED from your account, please email your proof of payment document to this address: proofofpayment@payfast.co.za so that that PayFast can verify the payment and complete the payment process back to our account. Please copy in info@cover4profs.co.za when you email proofofpayment@payfast.co.za. Please do NOT send your proof of payment to any other address except the PayFast address above. Until this verification has been completed you will not have insurance cover.

PayFast assures us that once you send the proof of payment to them, they will generate a "successful payment" to ITOO/Hollard, and your application will automatically complete, process and send your Certificate of Insurance to you. If you do not receive your updated insurance certificate within 48 hours after PayFast have confirmed your payment please contact us in order for us to assist you further. You first have to email PayFast though.

If the entire payment process completed successfully i.e. after payment you were informed that your payment was successful and asked to generate your certificate via the instructions on the screen, then it is not necessary to send proof of payment to anyone. If you received your certificate it means that your payment was processed perfectly and you are a valid policy holder.

If you have checked in your junk mail and you did not receive your updated policy Certificate via email AND if the payment WAS DEDUCTED from your account, please email your proof of payment document to this address: proofofpayment@payfast.co.za so that PayFast can verify the payment and complete the payment process back to our account. Please copy in info@cover4profs.co.za when you email proofofpayment@payfast.co.za. Please do NOT send your proof of payment to any other address except the PayFast address above. Until this verification has been completed you will not have insurance cover.PayFast assures us that once you send the proof of payment DOCUMENT to them, they will generate a "successful payment" to ITOO/Hollard, and your application will automatically complete, process and send your Certificate of Insurance to you. If you do not receive your updated insurance certificate within 48 hours after PayFast have confirmed your payment please contact us in order for us to assist you further.

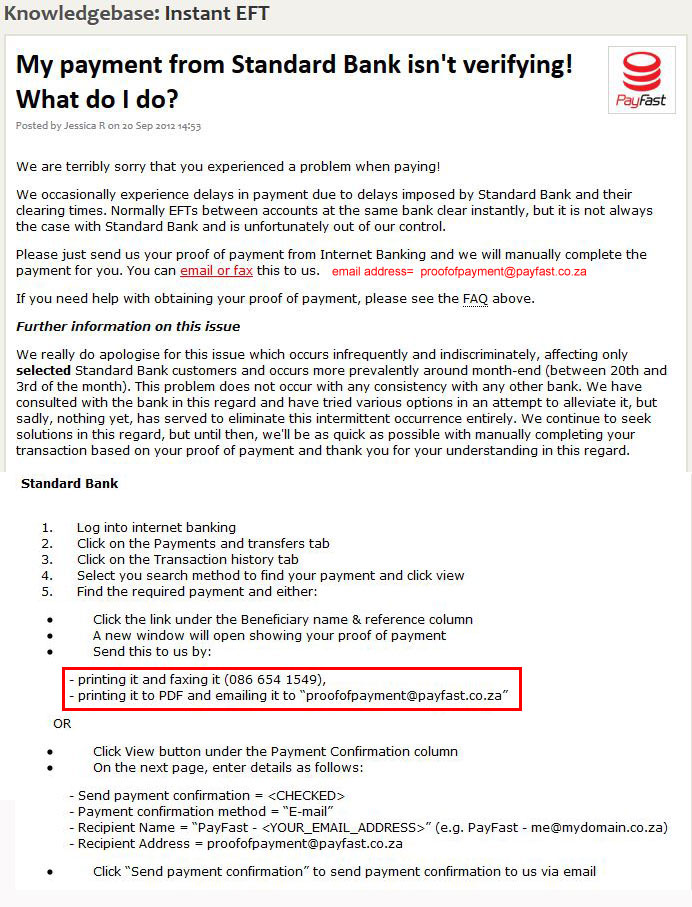

We asked the wonderful support people at PayFast why this happens and they sent us this information and how to fix the problem.

PayFast assures us that once you send the proof of payment to them, they will generate a "successful payment" to Hollard, and your application will automatically complete, process and send your Certificate of Insurance to you. Please do NOT send your proof of payment to any other address except the PayFast address above. Until this verification has been completed you will not have insurance cover.

We asked the wonderful support people at PayFast why this happens and they sent us this information and how to fix the problem.

What is 3D Secure / Verified by Visa / MasterCard Securecode?

- 3D Secure is a technical standard created by Visa and MasterCard to further secure CNP (Card-holder Not Present) transactions over the Internet.

- 3D Secure protects your credit card against unauthorised use when you shop online. This simple service enables you to validate transactions you make over the internet by requesting a personal code (usually sent to your cell phone or email address as a one-time PIN). It helps protect your account from fraudulent use by unauthorised individuals.

- 3D Secure is an extra layer of security in using your credit card for online transactions. For certain online transactions you'll be asked to enter your 3D Secure password (different from the PIN), which is called Verified by Visa and MasterCard SecureCode by the respective credit card companies.

- You have to register for 3D Secure with your card-issuing bank, and can be set up either as a password of your choice or a one-time-password that will be sent to you by email/SMS.

- PayFast have taken a measured approach to the use of 3D Secure and generally don't use it for low-value transactions or where the fraud risk is low so as to not unnecessarily impede such transactions.

- By default, PayFast turn on 3D Secure for all transactions over R1,000.00 but may also make use of it for transactions of lesser value at our discretion.

How do I register my Credit Card for 3D Secure Verification?

For MasterCard:

- Navigate to Mastercard's securecode site.

- Type in the name of the institution which issued your credit card as well as the country where it was issued and click "Go".

- Click the link to your institution's 3D Secure site and follow the instructions as necessary.

For VISA:

- Navigate to VISA's Verified by VISA site .

- Follow the instructions provided.

The links for banks in South Africa are as follows:

If, for some reason, you did not complete the payment process successfully - please note the following:

- Please check to see whether you received the Tax Invoice in your E-mail. (Please also check your junk or spam email folders - it might have landed there.)

- There are instructions in the Invoice Email that we sent you on how to proceed with the payment of your premium.

- The Invoice will only be valid for 7 days and will automatically be deleted from the system thereafter.

- Your completed application does not secure cover. Cover will only be in place once payment has been made.

When you are ready to make the premium payment:

- Access the `Log-In` option from the main menu at the top of the screen.

- Enter your Log-In details using the e-mail address and Password that you filled in on your SACNASP Professional Indemnity Insurance Scheme (SPIIS) Application form.

- Once you click the Log-In button on the screen you will be taken to your private Policy Profile page.

- You will see an option called "Pay Outstanding Invoice"

- Click on the button at the bottom of this option and follow the steps to complete your payment process.

- At the end of the successful completion of the payment process you will be instructed to generate your Insurance Certificate - which will automatically be e-mailed to you. If you do not receive your policy certificate within 48 hours, please first check in your junk mail and then contact us for assistance.

When you are ready to make the premium payment:

- Access the Log-In option from the main menu at the top of the screen.

- 2. Enter your Log-In details using the e-mail address and Password that you used when you completed the on-line SPIIS Application form.

- Once you click the Log-In button on the screen you will be taken to your private Policy Profile page.

- You will see an option called "Pay Outstanding Invoice"

- Click on the button at the bottom of this option and follow the steps to complete payment.

- At the end of the successful completion of the payment process you will be instructed to generate your Insurance Certificate - which will automatically be e-mailed to you.

- If you do not receive your policy certificate within 48 hours, please first check in your junk mail and then contact us for assistance.

If you completed the process up to the point just beyond the "Save" button on the Application Form, the chances are that the application was saved and the Invoice was e-mailed to you - but it disappeared. Not to worry, you can request a copy by following these steps:

- Access the Log-In option from the main menu at the top of the screen.

- Enter your Log-In details using the E-mail address and Password that you filled in on your SPIIS Application form.

- Once you click the Log-In button on the screen you will be taken to your private Policy Profile page. (If the system won't let you in, then maybe you did not get to the "Save" point when you were completing the form. Contact our Support team for help by clicking here .)

- You will see an option called "Request a copy of your Tax Invoice"

- Click on the button at the bottom of this option - the invoice will be generated and emailed to you. Please wait for the screen to advise you that the process is complete before exiting the screen.

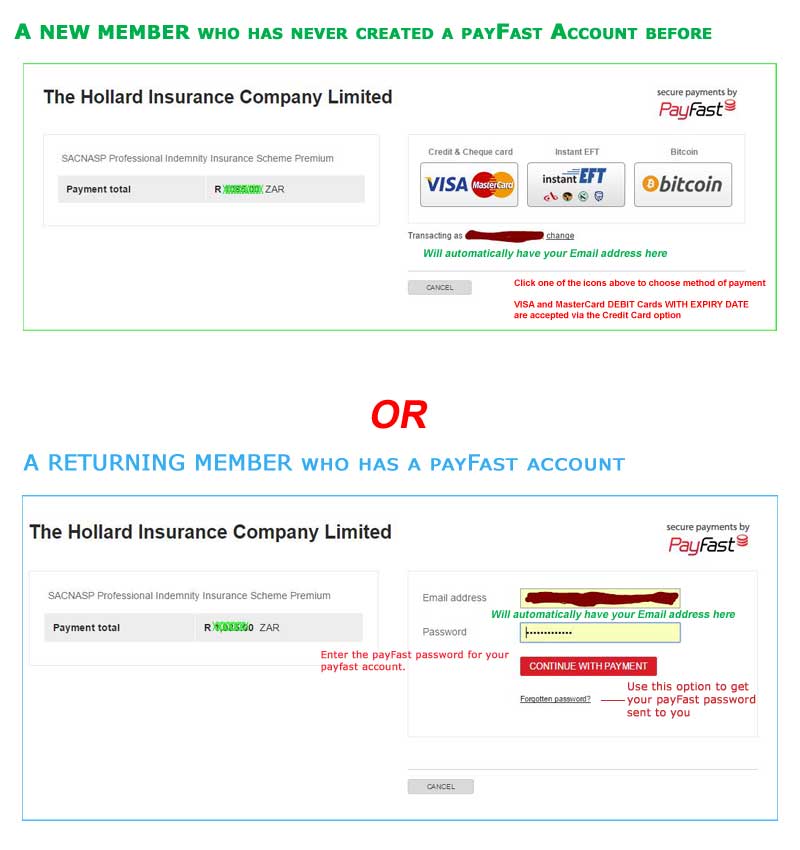

Here is an example with instructions what you need to do. Please note that they ask for an 8 DIGIT PASSWORD - please don´t use the same one that you entered for the SACNASP Application form - because that is only 6 digits.) The new password will be used by you to access the PayFast system only.

The system won't let you back in to create another application if your first application was already saved. You cannot enter two different applications with the same e-mail address.

Please urgently contact Garrun CFP here and provide them with the reasons for your changes, etc. They will be able to reset your application by arranging to have your previous application deleted in order for you to start the application process again. PLEASE NOTE: THIS CANNOT BE DONE IF YOU HAVE ALREADY PAID YOUR PREMIUM! If you need to make changes to an existing policy please contact Garrun CFP.

If, for some reason, you did not complete the entire payment process successfully - but you DID receive your Tax Invoice, please note the following:

- We confirm that the generation of this Tax Invoice in no way obliges you to take up the Policy Cover.

- The Invoice will only be valid for 7 days and will automatically be deleted from the system thereafter and you will need to apply again should you still wish to take up the cover.

- Insurance Cover will only be in place once payment has been made.

- A certificate of insurance will be issued to you as proof that your cover is in place, only once payment has been made.

When you are ready to make the premium payment:

- Access the Log-In option from the main menu at the top of the screen.

- Enter your Log-In details using the e-mail address and Password that you filled in on your SPIIS Application form.

- Once you click the Log-In button on the screen you will be taken to your private Policy Profile page.

- You will see an option called "Pay Outstanding Invoice"

- Click on the button at the bottom of this option and follow the steps to complete payment.

- At the end of the successful completion of the payment process you will be instructed to generate your Insurance Certificate - which will automatically be e-mailed to you.

We accept payment by credit card, debit card, EFT (via Internet Banking) through the links provided on our system. If you pay by some other means the automated process will not work and your cover will be compromised as a result.

No, under normal operation, you don't need to send proof of payment to either of us. The PayFast's system confirms that the funds have actually been received so there is normally no need for an e-mail or a fax from the bank as further confirmation.

However, if an error occurs during payment, please can you e-mail the proof of payment document to proofofpayment@payfast.co.za . For example, problems with payment verification can occur if there is a delay in the payment reaching us from the bank - or if the payment process "times out" because it takes too long to get the OTP back from your bank, etc.. In such cases, PayFast will need to see the proof of payment document to resolve the matter as promptly as possible. Until they receive proof of payment, you will not be insured.

Due to the nature of professional indemnity insurance claims- we do not use claim forms.

In the event of a claim or a circumstance which could give rise to a claim, please contact Garrun CFP so that we can assist you. It is very important that you confirm your notification in writing so that there is a record of when you sent it to us.

Please will you also contact us telephonically if you have not received written acknowledgement within a few days of your e-mailing to us a claims’ notification

is a condition of the cover that you notify us as soon as you become aware of any incident or circumstance which could lead to a claim or a complaint against you. You should please not wait until an actual claim is made against you before notifying us. If you wait until an actual claim is made against you and it is discovered that you were aware of the situation or should reasonably have anticipated that there were circumstances which could give rise to a claim against you and you failed to notify them through timeously- the insurers could reject the claim on the basis of ‘late-notification.’ In my experience, late notification is the number one reason for rejection of professional indemnity claims.

If you would like to notify us of a potential claim, you should please include brief details of the matter as well as your contact details so that we can let you know if insurers require any additional information from you. Please also include your SACNASP registration number as we would need to confirm that you were paid-up before we could offer assistance.

Please be aware that any disclosures that you make to us in your written notification will generally not be subject to the protection of ‘legal privilege’. As a result, if there is ever litigation arising out of the matter- the other side may subpoena us to produce our records, including your notification. While we have never been subpoenaed before for this purpose, we need to make you aware that this is a potential risk. This is why we would urge you to provide us with brief details. In the event that the matter does turn litigious, insurers will appoint an attorney to assist you and your disclosures to the attorney at that stage would be protected by ‘legal privilege’.

We would urge you to read the claims’ notification provisions in your policy document so that you do not unwittingly breach a condition of cover which could lead to a claim being rejected. More specifically, please will you read the definitions of `Any on Claim’, ‘Claim’ and ‘Circumstance’ found at 3.1, 3.2 and 3.3 on pages 2 and 3 of your policy document, and please very importantly read Conditions 1 and 3 on page 11 of your policy document, which deal with timeous notification of potential claims and not admitting any liability.

All premiums are once off annual premium. The underlying scheme policy runs from 1 April to 31 March the following year. Your policy may have a different policy period dependant on when you joined the scheme.

- When you come through to the PayFast payment page, select Instant EFT and then select the bank which you bank with.

- The next page will give you a link to launch your Internet Banking as well as account details to make payment to.

- Using the launched window, you simply login as per normal and make a once off payment to the account details provided for the indicated amount.

- Once you have done so, log out of internet banking and return to the window with the PayFast payment page where you click the “Verify my payment button”.

- The system will then verify your payment has been received and complete the payment.

We are pleased confirm that policies renewed from 1 April 2021, now includes cover for general legal advice as per the endorsement wording which will appear on your policy schedule going forward and extracted below for your ease of reference:

-

Legal Assist Endorsement

In consideration of the premium charged and paid and notwithstanding anything to the contrary contained in the policy, it is hereby agreed and noted that as a ITOO Specialist and General Liability policy holder, we will pay on behalf of the Insured various legal services relating to the Insureds business activities. Such services are obtainable by contacting the ITOO Legal Assist line on 0861 102 033; 24 hours a day, 7 days a week. -

What You Get

Each policy holder has access to the following as per policy period:

- An unlimited 24/7 facility for telephonic advice and assistance;

The following will also be made available if deemed necessary:

- A face-to-face consultation with a qualified attorney;

- Up to three letters, matter and complexity dependent; and

- A follow-up consultation.

-

Exclusions

- Any claim, circumstance or notification related matter/s that may or may not be covered under this policy;

- Any advice on how to bring a claim under this policy;

- Any matters pertaining to any claims repudiated by the ITOO Special Risks (Pty) Ltd;

- Matters where the policyholder’s business does not have an economical or legitimate interest;

- Any matters related to family law;

- Any criminal matters;

- Credit control or debt collection;

- Issuing and service of a summons and/ or response;

- Any disputes between the policyholder and ITOO; and

- Any matter in which ITOO believes the policyholder has been dishonest or unethical.

Please Note:

- The legal assistance provided is separate from the cover provided under the SPIIS.

- Please access the Legal Assist helpline directly by contacting 0861 102 033. You should NOT contact Garrun CFP if you want to access the assistance provided under this extension - as the service is provided through iTOO’s chosen services provider and not by Garrun CFP.

- The Legal Assist helpline is there to assist you with legal advice in relation

to your business activities (i.e., you can be assisted with advice relating to

your professional services/practice that is covered under the SPIIS). This will

include:

- Contract reviews

- Shareholder agreements

- Supplier and procurement contract reviews

- Employment-related disputes

- Any other legal query that you may have regarding your business activities

The Legal Assist Helpline will NOT assist you with:

-

Any claim, circumstance or notification related matter/s that may or may

not be covered under this policy, nor any advice on how to bring a claim

under the SPIIS policy.

- It is a policy condition that you notify Garrun CFP in writing of any circumstances that you become aware of which could give rise to a claim or a complaint against you, as soon as possible after you become aware of them. You should NOT be using the Legal Assist helpline for this purpose- as it is only intended to provide you with general legal assistance which are not included under the SPIIS.

- If you need to report an actual or potential claim or complaint to us, you are welcome to phone us to discuss the matter and obtain advice, but please always let us have an email with the details, as written notification is required in terms of your policy conditions. You can address such claim notifications to our dedicated claims’ email address to ensure that they receive prompt attention at claims@cfpbrokers.co.za.

- If you have received any legal documents, like a summons, or a complaint with a deadline in it, please do not just send us an email. Please phone us before you send your email so that we can prioritise the handling of your matter to ensure that a response is submitted timeously on your behalf.

- Any matters pertaining to any claims repudiated by the ITOO Special Risks (Pty) Ltd.

- Matters where the policyholder’s business does not have an economical or legitimate interest;

- Any matters related to family law;

- Any criminal matters;

- Credit control or debt collection;

- Issuing and service of a summons and/ or response;

- Any disputes between the policyholder and ITOO; and

- Any matter in which ITOO believes the policyholder has been dishonest or unethical.

When you call the helpline for assistance, please can you provide the following information:

- Your full name as per your certificate of insurance or policy schedule; and

- Your SAOA policy number which is “SPL/SLFG/000008733”. You can also find this number on your invoice/proof of insurance letter.

Remember to renew your cover if you have not already done so, before the end of March 2021

If you have not yet renewed your cover or if you need instructions on how to download your certificate of insurance, please send an email to insurance-saoa@cfpbrokers.co.za and you will receive an automatic response with instructions.

Please remember if you have not already renewed your cover, that the grace-period to do so ends on 31 March 2021. If you have not renewed your cover by this date, you will forfeit all your retroactive cover, i.e., you will lose cover for all services rendered in the past and you will therefore have a gap in your cover. You would then only be covered for claims and complaints arising out of services rendered/products supplied on or after the date that you pay to renew your cover in 2021.

We hope that this new benefit will prove useful to you and as always would be grateful for your feedback if you do use the service. Please send any feedback you are happy to share with us to Noleen .

Please feel free to contact us if you have any questions or concerns. Our contact

details are as follows:

Switchboard: (011) 794 6848/7770

General queries:

info@cfpbrokers.co.za

Claims and

incident notifications: claims@cfpbrokers.co.za

You will unfortunately not be able to use our Instant EFT payment method for the moment, if you don't bank with ABSA, FNB, Nedbank, Standard Bank, Capitec Bank or Investec. PayFast plans to add additional banks in due course as well as additional payment methods to make the system available to more users.

PayFast holds bank accounts at ABSA, FNB, Nedbank, Standard Bank, Capitec Bank or Investec. When you pay, you pay into a bank account held at the same bank as your own. Because it's an internal transfer, the payment takes place instantly and PayFast is able to positively acknowledge that the funds have reached our account in a matter of seconds! Aren't they clever! No more waiting for days before you can get proof of your Insurance Cover.

Visa or MasterCard branded debit cards can be used on PayFast.

In short, very safe! PayFast says this about their security: "Security is one of our

top priorities and one of the areas where we feel a lot of merchants and existing

payment processors are lacking. We make every effort to ensure the security of your

details provided to us, and will continue to increase the security of the service we

offer through the effective use of technology."

"With regards to bank details

specifically, you are not required to give us your banking details."

Absolutely! And often more so than many other payment methods! PayFast is developed with the same demands on security and performance as web sites used for banking services and share trading. Your account login, personal details and all money transactions are secured using Secure Socket Layer (SSL) technology with high security 256 bit encryption. Your sensitive financial information (like credit/debit card details) is never sent to the people you pay! So you can send money without sending your financial information! So you don't need to worry about paying people you don't know. We make use of 3D Secure to further enhance the security of credit card transactions on PayFast for all high value transactions.

Visa and MasterCard credit cards can be used on PayFast. PayFast will be looking into accepting Diners Club and American Express (Amex) in due course depending on demand. We accept payment by credit cards, debit cards, EFTs (via Internet Banking) and cash (via Ukash and mimoney).

Yes, we make use of 3D Secure for selected credit card transactions.

We have taken a measured approach to the use of 3D Secure and generally don't use it for low-value transactions or where the fraud risk is low so as to not unnecessary impede such transactions.

By default, we turn on 3D Secure for all transactions over R1,000.00 but may also make use of it for transactions of lesser value at our discretion.

You will not qualify for cover under the SACNASP Professional Indemnity Insurance Scheme (“SPIIS” Scheme) if you answer “yes” to any of the questions below. However- if you do not qualify for cover under the SPIIS Scheme we can still assist you with stand-alone quotes for your consideration. If you do not qualify for cover under the SPIIS Scheme and would like us to obtain quotes for you, please will you access our ‘Non-scheme proposal form’ which you will find in the drop-down menu under the “Application” tab at the top of the screen. Alternatively, please e-mail us here and request a copy of the proposal form and we will e-mail it to you.

Have any claims been made against you, your fellow directors and/or your company in

the past 5 years which would be covered under this type of policy?

AND / OR

Are you aware, after enquiries have been made of

your employees and fellow directors of any circumstances or incidents in the past 5

years, which could result in a claim or complaint being made against you and/or your

company which would be covered under this type of policy?

AND /

OR

In respect of an existing or previous professional indemnity

insurance, has any Insurer declined to provide insurance for the company which you

are now applying for cover for?

AND / OR

In

respect of any existing or previous professional indemnity insurance, has any

Insurer imposed harsher or special terms as a result of your claims’ history?

AND / OR

In respect of an existing or previous

professional indemnity insurance, has any Insurer cancelled your insurance

policy?

If the answer is yes to any one of the above questions your Company

does not qualify for cover under the SPIIS and you will need to

CLICK HERE to download and complete a different proposal form and return it

to us to obtain separate stand-alone quotes for your consideration.

Directors of the company:

In order to qualify for cover under the SACNASP Professional Indemnity Insurance Scheme (“SPIIS Scheme”, all the directors of a company or close corporation need to qualify for SACNASP registration. However, you can still obtain cover under the SPIIS Scheme if those directors who do not qualify for SACNASP registration, are either completely inactive in the running of the company or cc, or these directors are involved in a capacity which falls within the description of administration, legal and accounting functions which are necessarily ancillary to the provision of natural science services.

If any ONE director does NOT qualify for SACNASP registration and renders services which fall outside the 4 allowed non-registered categories, namely: administration, legal, accounting or they are inactive - your Company does not qualify for cover under the SPIIS and you will need to CLICK HERE to download and complete the 'Non Scheme' proposal form and return it to us to obtain separate stand-alone quotes for your consideration.

Please note that unless you have at least ONE director that qualifies for SACNASP registration, you do not qualify for cover under the SPIIS Scheme as the cover is restricted to SACNASP registered scientists only. If none of your directors qualify for SACNASP registration and you would still like to obtain quotes for professional indemnity insurance, please CLICK HERE and you will be re-directed to a screen where you may download and complete a special form and return it to us so that we can obtain separate stand-alone quotes for your consideration.

In order to qualify for cover under the SACNASP Professional Indemnity Insurance Scheme (“SPIIS Scheme”):

- The total number of your staff including yourself and any fellow directors and/or members cannot exceed 10; AND

- Your annual turnover (whether you are applying for cover for an individual or for cover for a company or close corporation) cannot exceed R5 million.

Please note that the insurance provided under the SACNASP Professional Indemnity Insurance Scheme (“SPIIS Scheme”) only covers services which fall within the scope of the natural sciences professions or ancillary services which are necessarily incidental to rendering such services, eg administration, accounting and legal services.

No cover will be provided for claims arising out of any services rendered which fall outside the scope of the natural sciences professions and those services necessarily ancillary thereto). If you are unsure whether or not services you render would be covered by this policy, please contact us for confirmation BEFORE PROCEEDING WITH THIS APPLICATION.

Alternatively, if you require cover for services which fall outside the scope of the natural sciences professions, please CLICK HERE to download and complete our ‘Non-scheme’ proposal form and return it to us to obtain separate stand-alone quotes for your consideration.

Please note that no cover will be provided under the SPIIS on-line registration cover for the following professions:

- Any professional in the building industry, namely: Engineers including architects / quantity surveyors / construction contractors / Chemical and Mining Engineers, etc.,

- Valuers & Loss adjusters

(these exclusions do not apply to the professional indemnity section of the policy. They only apply to the public & product liability sections of the cover. This means that you will still be covered subject to all the other terms, conditions and exclusions of the policy, for any claims arising out of allegations of negligent advice or breach of professional duty relating to any of the excluded items below). Please note that under the public and products’ liability sections of the policy there is no cover for any claims / damages / losses either directly or indirectly relating to the following:

- Blood Banks, Blood Products and Blood Transfusion Services

- Marine Liability and/or Marine Products

- Livestock business including spread of disease

- Known exposures to Polychlorinated Biphenyls (PCB s)

- Infectious epidemics/pandemics

- Marine protection and indemnity risks

- Waste disposal and/or toxic waste

- Pharmaceutical products including implantation medical devices

- Any involvement relating to: Wood preservatives; Corrosion preventatives; Chloric cleaning agents; Insecticides and pesticides; Herbicides; Fertilisers; Animal Feed where chemical additives are used in the preparation of such feeds; Hazardous Chemical Products; Medical equipment and dressings; Electrical and electronic controlled equipment; Paints and Lacquers; Cosmetic products, Medical implantation devices.

- Genetic Engineering

If you are a new client:

You can choose any date to start your cover from provided that you select a future date (not more than 30 days ahead) and you pay for the cover on or before the date that you need the cover to incept from.

WARNING: Please ensure that there is no overlap in cover between your expiring policy and this cover as this could lead to dual insurance issues. Please ensure that if you have cover in place currently that this policy incepts from the renewal date of your current policy - i.e. there should be no gaps in your cover.

If you are renewing your existing SPIIS cover:

Please ensure that if you have cover in place currently that this new policy incepts the day after your current policy period - i.e. there should be no gaps in your cover. If you leave even one day gap you will lose all your retroactive cover. For example: If your policy period is 01 April 2018 to 31 March 2019 then your new policy should incept from 01 April 2019.

You only have a grace period of 2 months and you need to ensure that you have paid for the renewal of your cover within the 2-month grace period.

The complete set of official policy documents - which can be viewed on line or downloaded, can be found on our "Policy Documents" page .

How to Download a Document to your computer

- Move your Mouse over the area which has the document name or form name (blue link).

- Right Mouse Click on the blue link and choose “Save Target as …” Or “Save Link as …” depending on the browser you are using i.e. Internet Explorer or Firefox or Chrome, etc.

- Choose a folder on your System where you want to save the file.

- Click the Save button.

We have an Online Quotation facility available to you here. Please note that this online quotation is entirely subject to the qualifying criteria of the SACNASP Professional Indemnity Insurance Scheme (‘SPIIS’). These qualifying criteria (short explanation) can be found on our Frequently Asked Questions page.

This online quotation is meant to only provide a cost guideline and is NOT the final quotation or invoice for payment. In order to receive a valid tax invoice, please complete the appropriate application for either Individuals or Companies

Professional indemnity insurance cover in South Africa is provided on what is known as a ‘claims’-made’ basis. This means that in order for you to enjoy cover under the policy you need to have cover in place:

- Firstly, at the time that you render the service which gives rise to the claim/complaint against you;

- Secondly, at the time that the claim/complaint is made against you (or at the time that you notify us in writing of an incident which you believe could give rise to a claim or complaint against you, whichever occurs sooner); and

- Lastly, there should be no gap in cover between 1 and 2 above, i.e. you need to have maintained your cover from the date of the service to the date that the claim is made against you or to the date that you notify us that you have become aware of circumstances which could lead to a claim or complaint against you.

Failure to have cover in place at any of the 3 points in time above will mean the rejection of your claim.

No. You can retain your retroactive cover under the SACNASP professional indemnity facility and you will not lose it, so long as there are no gaps in your cover, i.e., if your existing cover falls due for renewal on 1 April 2015 - then you would need to ensure that you incept your SACNASP cover from 1 April 2015 so that there are no ‘gaps’ in your cover and you would then retain your previous ‘retroactive cover date’ under your old policy.

It would be very important that you keep proof of your old policy because if you ever had a claim under the SACNASP policy which related to services rendered while your old policy was in place, you would need to be able to provide proof to the Insurers of your retroactive cover (and no gaps) prior to the inception of your cover through the SACNASP Policy.

It is a condition of all professional indemnity policies that you notify the insurers (through the broker) of all circumstances that you are aware of which could lead to a potential claim or complaint against you as soon as you become aware of them.

If you notify insurers of a claim against you and they establish that you were aware of a problem for some time before the claim arose- it is likely that they will reject that claim on the basis of late notification of the circumstance which you were aware of.

Therefore, if you have notified your existing insurers of a potential claim against you, and a claim is only made against you once you have taken out cover through the SACNASP facility, then your existing insurers will be responsible for finalising that claim.

So long as you notified your existing insurers of a potential claim against you and you have a record of this in writing, then subject to all other terms and conditions- they will respond to that claim- because all professional indemnity policy wordings state that a claim will be deemed to have been made as soon as you notify the insurers of a potential claim or circumstance.

We encourage you to incept your cover with SACNASP from the date that your existing cover would lapse. You can incept cover from any date if you are applying for cover for the first time- but please read our notes above about the nature of claims’-made cover.

Please also see our previous notes with regard to keeping your retroactive cover, reporting through any circumstances that you are aware of which could lead to a potential claim against you, and ensuring that you do not have any ‘gaps’ in your cover.

If a claim arises once you have moved to the SACNASP facility relating to services rendered whilst you were insured elsewhere and the claim comes completely out of the blue and you could not reasonably have foreseen the potential for a claim to arise against you, then, subject to all other terms and conditions of the Hollard policy (eg that you have notified us timeously in writing of the claim and paid your premium and have no gaps in cover), then Hollard will assist you with that claim, so long as you can prove that the services giving rise to the claim were rendered after the retroactive cover date under you prior policy.

It is very important to note that if you are aware of a potential claim against you (or insurers believe that you ought reasonably to be aware of a potential claim against you) prior to changing insurers and coming onto the SACNASP facility, you must notify your existing insurers of that potential claim BEFORE your policy with them lapses.

If you fail to do so and a claim arises after you have moved your cover to SACNASP- neither insurer will deal with it.

The old insurer will say that you cannot notify them because you no longer have a policy in place with them. The new insurer will say that you were aware of the potential for a claim to be made against you before you moved your cover and you should therefore have notified it to your previous insurers.

Also- please note that if you are aware of any incident or circumstance which could lead to a claim against you which would be covered under this type of policy or you have in the past 5 years had a claim against you which would have been covered under this policy then you do not meet the qualifying criteria for cover under the SACNASP Professional Indemnity Scheme.

We can still obtain quotes for your consideration but you will need to download, complete and return to us our non-scheme proposal form here in order for us to obtain quotes for you.

Under the SACNASP facility you can choose cover limits of R2,5 million, R5 million or R10 million each and every claim.

In the event that you need to increase your cover above R10 million once you have placed or renewed your cover on-line, you would need to contact us for assistance. We are able to assist you with higher limits of cover’.

Yes. You can contact us at any time to increase your cover limit. Please note however that this can not be done on-line. We would need to assist you and issue you with an invoice for the additional premium due.

We would then send you a policy endorsement reflecting the date that your limit has increased on.

However please note that you cannot increase cover only once you are aware of a potential claim which might exceed your current limit.

All claims arising out of circumstances/incidents known to you (or which aught reasonably to have been known to you) when you increase your limit will not be covered under the higher limit of cover.

We would therefore urge you to give serious consideration to the possible quantum of any claim that might be made against you and to ensure that you take out appropriate cover for your exposures.

If you would like us to send you a document which discusses considerations when deciding on an appropriate limit of cover, please will you e-mail us requesting this document at noleen@cfpbrokers.co.za .

SACNASP started the investigations into putting together a professional indemnity facility for their registered scientists. Garrun CFP was recommended to SACNASP by a Lloyd’s Coverholder who was approached to assist SACNASP (General and Professional Liability Acceptances (Pty) Ltd).

Garrun CFP is an authorised financial services provider who is licensed by the Financial Services Board. We hold professional indemnity insurance of R20 million and we are willing to provide proof to anyone who may request a copy from us.

Garrun CFP currently looks after 5 other such facilities: SAOA, SAOPA, SASOHN, BASA and SASP which between them have over 7000 professional members.

Garrun CFP is a specialist in all liability insurance lines and includes among their clients architects, accountants, lawyers, engineers, clinics, valuers, quantity surveyors, healthcare professionals, medical-aid administrators, trustees, financial services providers, insurance underwriters, professional societies and associations and consultants and advisors in various professional fields.

Garrun CFP does not accept the payment of any premiums on the SACNASP on-line scheme. All premiums are paid directly to insurers via PayFast. Insurers are then responsible for paying Garrun CFP their commission which is 20% and binder fee of 5%.

Hollard Insurance Company Limited is a reputable insurance company and we have no hesitation in recommending them to you. They employ underwriters with a wealth of experience in the field of liability insurance and expertise in the field of professional indemnity insurance.

In terms of South African law, the employer is vicariously liable for the negligent actions and omissions of its employees which occur during the course and scope of their employment and which cause loss, harm or damage to a third party or their property.

Most companies take out professional indemnity insurance to cover themselves for their vicarious liability exposure and their employees are generally included under their policy as ‘insureds’.

Our experience has been that attorneys adopt a ‘shot-gun’ approach and will sue both employer and employee as joint defendants.

With regard to employees specifically of a large mining house, it is more than likely that you would already be covered under your employer’s professional indemnity insurance policy, but it would be worth your while making enquiries about this with your employer.

You would also need to find out from your employer whether or not their policy would respond to cover your legal defence costs in the event that you need to defend yourself against allegations brought against you at SACNASP that you have infringed the ethical code. If you have to pay for your own legal defence at a SACNASP inquiry, you could easily incur costs in excess of R50,000.

The SACNASP Scheme policy provides cover of R100,000 for your legal defence costs in instances where the allegations made against you at SACNASP could also result in a claim against you or your employer for your professional negligence.

You are correct but the cover which is offered is known as personal or public liability which is not the same thing as the cover being offered under the SACNASP facility.

The cover being offered under the SACNASP facility is professional indemnity insurance.

To distinguish the differences between these 2 types of cover:

-

Personal liability cover is usually offered under your own personal policies eg-

your home owner’s policy and it would respond to personal liability you might

incur, eg someone visits your home and is bitten by your dog.

You are not covered at all for a business-related claim. For example if it is determined that you run your business from home and the person who your dog bit was there for business reasons, the claim will generally be rejected unless you have declared to your insurers that you operate your business from home and they have accepted this risk.

Public liability cover is usually offered as an extension under a business insurance policy, eg, your office contents policy.

It is colloquially known as ‘slip-and-trip’ cover and covers you for liability which you may incur toward a member of the public as a result of conducting your business, for example, if you do not warn your visitors that the floors are wet and the slip and injure themselves.

However, please note that both personal liability and public liability extensions offered to you under other policies will specifically exclude your liability arising out of professional services rendered or professional advice and will also generally exclude any products’ liability type claim. -

Professional indemnity insurance which is what is being offered under the

SACNASP insurance facility, is triggered by any allegation of negligence against

you in the rendering of a professional service or advice. It is the equivalent

of medical-malpractice cover for doctors.

No doctor would rely on the personal or public liability extensions under their office contents or home-owner’s policies to cover them for claims against them for malpractice. In any event, such claims would never be covered under the public or personal liability extensions because as mentioned above, claims arising out of professional services and advice are specifically excluded under personal and public liability covers.

Under the SACNASP facility, you are also offered public liability and products’ liability extensions of cover. These are separate and distinct types of cover.

Simply put, a claim for negligence arising out of the rendering of professional services or the giving of advice will not be covered by the public liability extensions on your other policies.

Professional indemnity insurance is a very specific type of insurance which covers a completely different risk.

You can apply for ‘corporate’ cover under the facility. The company, partnership or close corporation will be covered under the SACNASP facility so long as all the directors, partners or members of the company, partnership or close corporation take out the cover under the SACNASP facility.

Where you are applying for cover for a company, all employees whether qualified, certificated or candidates should also be encouraged to take out the cover individually if you do not include them in your company application as they will not be covered if they are sued in their individual names together with the company or if they have a complaint against them with SACNASP, unless they have the cover in their own names through the SACNASP facility (whether you have named them under your company policy or they have taken up the cover as an individual).

What about employees of a company who do not qualify to register with SACNASP, will they be covered under the ‘corporate’ option? Yes. They would be on condition that all the directors, members or partners of the company, close corporation or partnership have taken up cover through the SACNASP facility.

Yes, the excess depends on your limit of indemnity.

There is an excess under the main sections of the policy of R5,000 for each and every

claim where amount insured is R1 million, R2,5 million or R5 million. The higher

limits of indemnity have higher excess requirements as follows:

R10 million

limit has an excess of R10,000 for each and every claim.

R15 million limit has an

excess of R15,000 for each and every claim.

R20 million limit has an excess of

R20,000 for each and every claim.

The excess in respect of the extensions of cover follows the main limit or is R2,500 as printed on certificate.

- Professional indemnity limit selected by you is per claim/occurrence.

- Public liability limit is the same as the main limit of indemnity on an aggregate basis.

- Product liability limit is R1 million per claim and for the period of insurance, i.e., it is an aggregate limit which means that you would have one ‘bucket’ of R1 million to meet all product liability claims made against you in a given insurance period.

- Statutory defence costs limit is an aggregate limit of R250,000 per insurance period (the year that the policy runs as from the inception date)

Please refer to the SPIIS Master Policy Document and Notes - General. The exclusions are found on pages 18 and 22. Please do not hesitate to contact us if you have any questions about any of these exclusions.

It is very important that you also note the separate exclusions which apply to the public and products’ liability sections of the policy. You can find these on pages 26 and 27 of the SPIIS Master Policy Document and Notes - General , at the bottom of page 35.

Please do not hesitate to contact us if you have any questions about any of these exclusions.

It is important that you read the exclusions together with the SPIIS Master Policy Document and Notes - General which are found on pages 34 to 37 of the policy document.

The most important conditions of cover are:

- You need to have paid for the cover. Please see the answers above with regard to the nature of claims’-made cover and how it works;

- You need to notify us, in writing, as soon as you become aware of any circumstance which could lead to a potential claim or complaint against you, regardless of whether you think the claim would only be a small one, or you don’t think the person/client or company would claim or they have not intimated that they intend to claim against you;

- You should not make any admissions of liability or enter into any kind of settlement negotiations without the prior consent of the underwriters.

In our experience it is the insured’s unwitting infringement of the above 3 conditions of cover that lead to about 95% of the rejections of claims. There are very few claims which we see which are rejected on the basis of any particular exclusion of cover.

No. Cover is worldwide excluding North America. However please note that if you moved to another country or live in another country- it would not be the intention that this policy would cover you. You would then be advised to take out cover in the country to which you had moved or in which you live.

This policy would however cover you for work you do in other countries excluding North America so long as you or your company who contract to do the work are still domiciled/registered in RSA.

The facility would provide cover for the Insured worldwide excluding North America (meaning USA, Canada and any territory which laws fall under the auspices of the United States of America or Canada).

Where you have any agreements in place with clients in North America, such contracts usually contain a jurisdiction clause and where the jurisdiction clause states for example that USA jurisdiction applies, then the laws of USA would apply and this policy would not respond.

As such we would suggest that if you are contracting with North American clients or doing work in this area that you then obtain specific insurance for services rendered in and/or work done for clients in North America to ensure that you have cover in this particular area where this policy will not provide the cover.

Cover will be provided so long as no more than 50% of your turnover is derived from services provided outside South Africa and that no more than 40% of your turnover can be derived from Austalia.

We use insurers and underwriters that have a long-track record in offering liability insurance. Our experience has shown that this is very important, as there have been many insurers, mutuals and underwriters that have pulled out of certain indemnity markets in South Africa.

iTOO™ Special Risks (Pty) Ltd, an authorised Financial Services Provider, is Hollard’s underwriting management agency, which focuses exclusively on specialist liability insurance. iTOO™ offers a team of 30 specialist liability underwriters with a wealth of expertise in underwriting. iTOO™ offers 13 dedicated Claims’ Specialists (4 of whom are qualified attorneys) with years of experience in handling a wide range of liability claims.

The Hollard Insurance Company Ltd., an authorised Financial Services Provider, is South Africa’s largest privately-owned insurance group. Their turnover exceeds R15 billion. They have in excess of 6 million policyholders. B-BBEE rating of Level 2. Hollard is a known and trusted brand with solid claims-paying ability. Global Credit Rating Company (GCR) confirmed Hollard’s national scale financial strength rating of AA in March 2020.

It would be advisable to rather arrange that you are covered under SACNASP when your current policy lapses.

We do not advise trying to cancel your current policy mid-term as many professional indemnity policies are annual non-cancellable policies and if you cancel them mid-term this could have serious implications in that many insurers would then cancel that policy from the most recent renewal date and you could lose years of retroactive cover depending on how long you have had the policy in place.

In indemnity policies you will often find what is known as a ‘non-contribution clause’. The policy effectively states that if there is any other insurance in place that should respond to the claim then this policy will not contribute or pay toward the claim.

The problem then arises that both policies will have a non-contribution clause and you will have both insurers arguing over whose policy is supposed to respond and this is usually complicated by the fact that both policies will have different terms and conditions, different limits and different excesses.

It is generally therefore not a good idea to have 2 indemnity policies in place at the same time.

However- the exception to this general rule would be if the one policy offers you benefits that are not offered under the other policy. So for example, if your current policy would not respond to cover you for a products’ liability related claim or an allegation that you have breached a statute or to assist you with legal defence costs in a SACNASP inquiry- then there is no problem- as there is effectively no dual insurance in these instances as the policy you currently have in place does not provide these benefits.

If you do decide to take out 2 policies for the reason above, please make sure that you notify the brokers on both policies in the event that you become aware of any circumstances that could lead to a potential claim against you.

You should not try to avoid the issue of dual insurance by only notifying one insurer as this could back-fire on you if that insurer rejects your claim for some or other reason and you have then lost the opportunity to test whether the other insurer would have dealt with the claim because your notification at such a late stage would then constitute late notification and the 2nd insurer would also be entitled to reject the claim on this basis alone.

Unfortunately not. The SACNASP cover is only available for individuals who are domiciled in RSA and for companies that are registered in RSA.

No. The rates are for individuals so if the botanist wishes to be covered in his/her own name for work that they are doing they will need to also take out the cover too.

However, you would be covered if you have the cover and your consultant has not taken up cover and you are sued as a result of their alleged negligence.