Why choose the CFP Medical Malpractice Scheme Policy?

- The CFP Medical Malpractice Scheme Policy is underwritten by iTOO™ Special Risks (Pty) Ltd for and on behalf of The Hollard Insurance Company Limited.

- Outside of the Medical Protection Society, iTOO™ provides medical malpractice cover to the largest number of healthcare and medical practitioners in South Africa.

- The Hollard Insurance Company Ltd., an authorised financial services provider, is South Africa’s largest privately-owned insurance group.

- Hollard is a known and trusted brand with solid claims'-paying ability. Global Credit Rating Company (GCR) confirmed Hollard’s national scale financial strength rating of AA in March 2020.

As a CFP Broker's client, you have access to one of the widest medical malpractice insurance covers available in South Africa, at highly competitive premiums due to our negotiating power as a result of the large numbers of healthcare practitioners who have trusted us over the past 10 years to assist them with their medical malpractice insurance cover.

- CFP Brokers has years of experience assisting chiropractors which has enabled us to tailor-make the cover for your specific needs. For example: Legal assistance provided for ALL AHPCSA complaints against you, even where the complaint does not involve a possible claim of medical malpractice.

- Many other insurance products, do NOT provide you with cover for legal assistance where there is an AHPCSA complaint against you, unless there is a potential for that same complaint to lead to civil claim in court against you for professional negligence or medical malpractice. Our experience has been that this is in fact the greatest exposure to our medical malpractice scheme clients.

- By taking out medical malpractice scheme cover you are not individually underwritten. You are entitled to group rate premiums, regardless of your claims’ experience.

- If you take out individual medical malpractice cover you will have to declare all previous claims, incidents or complaints made against you and any circumstance which might give rise to a claim in the future. Even if the complaints made against you are baseless- you could find yourself in a position where another provider who initially provided you with very cheap terms- suddenly increases your premium significantly, or alternatively, declines altogether to renew your cover if your claims’ experience changes and you have a few claims/complaints against you.

If you already have a Malpractice account and/or have received a renewal reminder

If you want to Register a new account and take up this offer for the first time

For Chiropractors & related professions

The CFP Medical Malpractice Scheme Policy has been tailored for members of the Chiropractic profession as follows:

- Fully Qualified Chiropractors & Osteopaths

- 6th Year Chiropractor & Osteopathic Students & Interns

About this Policy Scheme

The Policy Schedule provides a summary of the cover under this policy, but it also includes additional terms and conditions of cover in the endorsements.

Please read the Master Policy together with all the endorsements on the Policy Schedule carefully and contact CFP Brokers if anything in these documents is unclear or requires further explanation.

- Professional indemnity insurance - This is cover for claims arising out of your negligence or alleged negligence in the rendering of professional services which has caused a financial loss to a Third Party.

- Medical malpractice indemnity insurance - This is a specialised form of professional indemnity and covers you for death or injury suffered by one of your patients as a result of your alleged negligence in the rendering of healthcare related services. The trigger for the policy is an allegation that your negligent action or omission has resulted in a patient suffering loss, harm, death or injury. Our bespoke wording has extended the definition of medical malpractice to include cover for failure to diagnose, misdiagnosis and delayed diagnosis.

- Public Liability Insurance (Optional) - Provides cover for your liability to members of the public arising out of the conduct of your business/profession. Please note that in order for the policy to respond there needs to be some kind of allegation of negligence against you which has resulted in harm to a member of the public or their property and you need to be legally liable to that person. Some examples of where you would be covered under the public liability section of your policy:

- you have a faulty hand-rail on stairs at your premises which you are aware of. A client falls down the stairs because the hand-rail comes loose and subsequently sues you for hospital expenses incurred and further damages; or

- the gate to your business closes on a client’s car causing damage. They allege that it was your fault because you did not ensure that you had sensors fitted to the gate and the gate closed before they had the opportunity to pass through it safely.

- Product Liability Insurance including defective workmanship (Optional) - Cover for claims which are alleged to have been caused by a product, defective packaging and/or labelling. If you sell a product or supply a product to a client and they allege that the product was defective and has injured them or damaged their property, this would constitute a products’ liability type claim.

- Defence Costs

- The main limit of indemnity is provided on an aggregate basis with one automatic reinstatement of cover. An aggregate limit means that you would have one exhaustible limit of cover for the period of insurance, which needs to be shared by all claims arising during that period of insurance. When you have an automatic reinstatement it means that, if your original limit is reduced by a claim, then Insurers will “reinstate” the limit back to the original amount. You will still be limited to your original limit per claim, i.e. you cannot add the reinstatement to the original limit to cover a claim which exceeds your original limit. Reinstatements are therefore only useful if you have multiple claims against you during the same period of insurance. The Reinstatement is NOT applicable to Students and Interns)

- All legal costs and expenses, damages, settlement awards, VAT and interest payments for all claims arising during the policy period will reduce the limit that you are covered for, for the balance of the insurance period. Although you can generally increase your limit at any time during the policy period, if you notify insurers of potential claims or if you have any claims during the period, it is unlikely that insurers will be willing to offer you terms to increase your limit of cover. Even if they do agree to allow you to increase your limit of cover, the limit of cover that you had in place prior to requesting the increase will apply to all claims arising out of incidents which you are aware of at the time that you request the increased limit.

- The limit of indemnity is inclusive of VAT. If you are a VAT vendor, you need to ensure that the limit of indemnity chosen can cover your VAT liability in the event of a claim.

- The excess under the main section of the policy is R5,000.00 increasing to R10,000 for Dry Needling and increasing to R50,000.00 once the Reinstatement Applies

The excess applies to costs and expenses which means that this is the amount you would be required to contribute toward any claim made under the policy.

- You will need to pay an excess if Insurers have had to incur legal costs and expenses in the investigation and defence of a claim against you, regardless of whether you successfully defend the claim or not.

- Statutory Defence Costs

- Wrongful Arrest

- Employers Liability (Optional)

- Indemnity to Others

- Cross Liabilities

- Defamation

- Breach of Confidentiality

- HPCSA Costs / Other Statutory Body Costs

- Court / Inquiry Attendance Costs

The policy document has been provided to you. It is your responsibility to ensure that you read and understand all the policy terms, conditions and exclusions and if you do not that you contact us, in writing, for clarification/explanations.

- If you have been a member of the CASA until 31 December you will retain your retroactive cover if you renew your cover prior to 31 March the following year.

- Many insurance providers do not offer you retroactive [backdated] or offer you limited cover. Retroactive cover is there to protect you if you have a claim or complaint which arises out of services you rendered in the past. If you have no retroactive cover, then you will have no cover for any claim or complaint which arises out of services which you rendered in the past.

- If you move your cover to another insurer, you could end up forfeiting retroactive cover that you are currently entitled to under the CASA policy. The longer you have been a paid-up member of CASA with continuous cover in place under the CASA policy, the longer the period of retroactive cover that you would be entitled to under the CASA policy. Some insurers may offer you up to 3 years’ retroactive cover at no cost. Please be very wary if they tell you that 3 years’ retroactive cover is enough. It is certainly NOT! Remember that a person has 3 years to sue you from the date that they become aware that they have suffered harm. This does not mean 3 years from the date that you rendered the service! Sometimes it could take months or even years for it to become evident to a person that they have suffered a loss. You also need to bear in mind, that prescription of a minor’s claim does not occur until 1 year after they reach the age of majority (or 3 years after they suffered the loss depending on which period affords them the longer period of time to sue you).

- Up to 6-years’ run-off cover included at no additional cost. This benefit is not offered under all policies. In some instances, run-off cover under other policies may be limited to 3 years or there may be no free run-off cover at all.

- Most will charge for the run-off cover. Due to the nature of claims’- made cover, if there is no run-off or extended reporting period under your policy- this means that you would have to continue to pay for the cover for a number of years after you have ceased to practice or retire because the cover afforded under the policy ceases as soon as you no longer have a policy in place.

Frequently Asked Questions

Click on a heading to see the FAQs for that topic

About the policy

In order to answer this question properly, we need to look at various clauses in your medical malpractice policy wording. Please have a copy of the policy wording document and the master policy schedule handy to refer to while you read this response.

- Cover is Provided “Within Territorial Limits”

- You will not be covered for any claims arising out of services rendered in North America or any territory that applies their laws and neither will you be covered if someone tries to enforce a judgement that they have obtained against you in North America or any territory that applies their laws or falls within their jurisdiction.

- Please read the Definitions of “Territorial Limits” and “North America” in your policy wording document.

- Cover is Limited to 60 Consecutive Days for Temporary Visits

- Please note that the cover that you enjoy for rendering services overseas is NOT for an indefinite period and is subject to certain restrictions. We urge you to read the relevant endorsement found in the Master Policy Schedule.

- This means that you will only be covered for services rendered overseas, so long as the services rendered overseas cover a period of less 60 consecutive days.

- That it is not the intention of the policy to cover you if you emigrate overseas. You should not then leave this cover in place for the first year that you are overseas as a cheaper option.

- The intention behind your Society/Association agreeing to this cover and our negotiating with your insurers to include cover- was to accommodate those people who are local members who may from time to time render services overseas, whilst they are visiting.

- The premiums for this cover are based on South African exposure and handling claims in overseas’ jurisdictions will immediately see a sharp spike in the costs of handling that claim which would impact on all the local members and potentially the affordability of the premium for everyone.

- It is therefore essential that if you will be emigrating to another country or rendering services in a country for longer than one year that you arrange cover there.

So, you are covered overseas, always subject to all the other terms and conditions of the policy being met, and so long as you are rendering services which fall within your scope of practice- i.e. you will not be covered if you go overseas and start rendering services as a book-keeper or any other profession not covered under your Association/Society’s policy.

If you render services overseas from time to time, we would recommend that you take one of the higher limits of indemnity available as the lower limits could leave you under insured. You need to maintain your cover at the higher limit not only when you render the services but for some years thereafter until the any potential claimants claim prescribes.

We hope that you found this response useful. Please feel free to write to us if you have any other questions regarding your cover at info@cfpbrokers.co.za.

We believe that the cover that we have negotiated with ITOO Special Risks offers one of the widest covers in the market. Below we have outlined just some of the cover offered under the policy:

MAIN SECTIONS OF COVER

Automatic Sections of Cover Included in All Cover Options:

- Medical Malpractice

- Professional Indemnity

- Defence Costs

Depending on the Cover Option Selected, additional sections may apply as follows:

- Public Liability

- Product Liability (including Defective Workmanship)

EXTENSIONS OF COVER

General Extensions:

- HPCSA/Other Statutory Body Costs

- Statutory Defense Costs

- Public Relation Expenses

- Wrongful Arrest

- Indemnity to Others

- Cross Liabilities

- Defamation

- Breach of Confidentiality

- Court/Inquiry Attendance Costs

- Business Identity Theft

- Temporary Cover for Treatments Rendered Overseas (max 60 consecutive dates excluding USA/Canada)

- Medico-Legal Work

- Medical Malpractice rendered at Events

- Defence costs in respect of services rendered within State Facilities/Hospitals/Departments

- Telemedicine / Telehealth (so long as regulations continue to allow for such services)

Additional extensions which may apply depending on the scheme and cover options:

- Medical Aid Investigation Costs/Audits

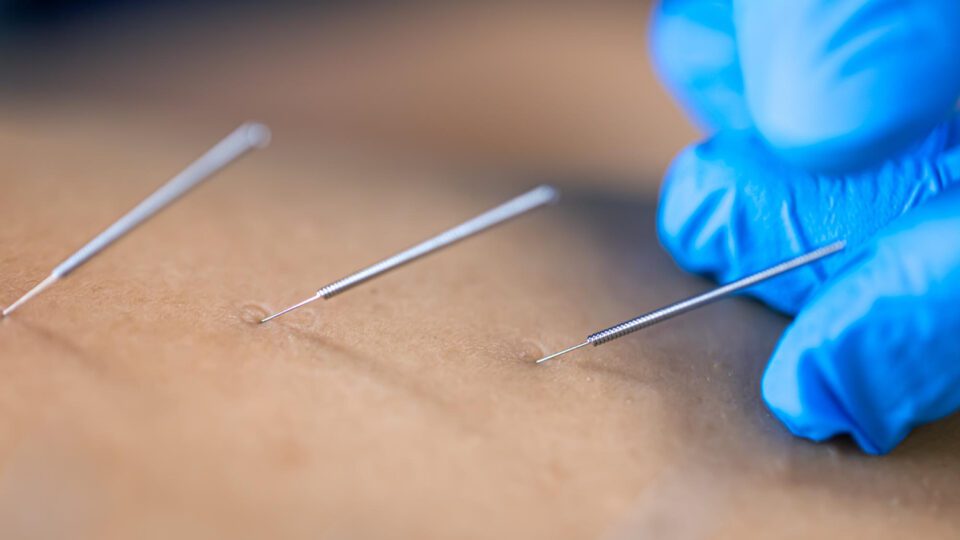

- Dry Needling

- Physiotherapy/Exercise Classes

- Aqua- physiotherapy

- Hippotherapy

- Animal Physiotherapy

- Employers Liability

- Public Liability at Events

- Academic Services

- Vicarious Liability

- Cover extended to cover the practice and not just the practitioner

The list above is NOT all inclusive so please feel free to contact us if you have any specific questions.

Below are just some reasons why we believe the CFP Brokers’ exclusive policy offers you cover that is a cut above the rest:

- Our favourable application of the Limit of Indemnity. Our policy applies the limit of indemnity which is in place when you notify the circumstance or the claim which give you the benefit of usually enjoying the higher limit as one usually increases the limit to stay in line with the mounting costs of medical malpractice claims.

- No barriers to exit. ITOO Special Risks (Pty) Ltd would honour previously notified circumstance and claims even if you moved your cover to another provider.

- We offer some of the highest sub-limits in the market on our cover extensions.

- Our policy automatically includes access to iTOO’s Legal Helpline 24/7– this facility alone can save you thousands of Rands annually, as you have access to legal assistance for reviews of your contracts and practice-related queries, including employment-related matters.

In order to keep this response as succinct as possible we have not outlined all the details of each section and extension of cover. If you have specific questions about the cover, please feel free to contact us.

Cover is afforded subject to the terms, conditions and endorsements of the policy.

Please note that in the list below we are providing information in respect of some of the exclusions of cover. We urge you to carefully read the policy schedule and policy wording document which provides full details of all of the exclusions of cover.

We need to remember that the CFP Broker’s policy is a legal liability policy intended to compensate third parties (others) for losses they allege that you have caused them to suffer. The policy is NOT going to cover you for losses you might suffer (aside from your legal defence costs). So, for example the policy is not going to assist you to take legal action against a person who you feel is defaming you.

The policy will NOT cover:

- You for losses you might suffer (aside from your legal defence costs). We need to remember that the CFP Broker’s policy is a legal liability policy intended to compensate third parties (others) for losses they allege that you have caused them to suffer. So, for example the policy is not going to assist you to take legal action against a person who you feel is defaming you.

- Claims/complaints arising out of services rendered which fall outside your scope of practice, unless such services fall under the Good Samaritan clause where you rendered services at the scene of an emergency.

- Claims/Complaints arising out of services rendered prior to your retroactive [backdated] cover date.

- Claims/Complaints which have not been timeously reported to CFP Brokers / your Insurers.

- The policy does not provide cover for fines, penalties, punitive, vindictive or exemplary damages imposed on you or awarded against you.

- The policy responds to cover your legal liability to compensate someone. Insurers will not pay every person who might injure themselves falling at your practice or who otherwise claims payment from you on some or other basis. Legal liability on your part has to be established before the policy will pay a third-party compensation. Your legal defence costs will be covered while your legal liability is being established or defended.

- If it is alleged that you have overcharged a patient, the policy is not going to refund you any amounts you pay to that patient or that you agree to pay in a medical aid audit.

- There is no cover for any allegations of sexual misconduct in the course and scope of your practice. However, if you are subsequently found not guilty or liable, then the policy will refund you your defence costs. For this reason- you should please notify us of any allegations against you or your employee of sexual misconduct.

- Claims/Complaints arising out of services rendered when you were under the influence of drugs or alcohol.

- Claims or complaints which you were aware of in a previous policy period but failed to notify us of at the time. Although please be aware that you do have a 30-day period after the end of the policy period (31 December) to notify us of any potential claims or complaints that you became aware of prior to 31 December.

- Claims for cyber-liability, employment practices’ liability, directors’ and officers’ liability and commercial crime.

- Losses that you suffer as the result of your own employees stealing from you.

- You will not have Public or Product Liability cover UNLESS you have selected a cover option which includes these sections of cover. If you enjoy cover under the public and products’ liability section of the policy, then you will not be covered for:

- Claims arising out of the failure of a Product, or any part thereof, to fulfil the purpose for which it was intended, or to perform as specified, warranted, or guaranteed; but this Exception shall not apply to consequent bodily injury or loss of, or damage to, property; or

- Claims arising out of recalling, removing, repairing, replacing, reinstating, or the cost of, or reduction in value of, any Product, if such liability arises from any defect therein or the harmful nature or unsuitability thereof.

- Claims for damage to property owned, leased or hired or under hire purchase or on loan to the Insured or otherwise in the Insured’s care custody or control other than:

- premises (or the contents thereof) temporarily occupied by the Insured for work therein, or other property temporarily in the Insured’s possession for work thereon (but no indemnity is granted for damage to that part of the property on which the Insured is working and which arises out of such work);

- employees’ and visitors’ clothing and personal effects;

- premises tenanted by the Insured, but only to the extent that the Insured would be held liable in the absence of any specific agreement;

- For claims or complaints arising out of any dishonest, criminal or malicious act or omission, or any act or omission in violation of any law or ordinance, committed by or on behalf of the

Insured, save where such criminal or illegal conduct is negligent and not reckless or intentional. - For claims or complaints arising out of any loss, damage, cost or expense directly or indirectly arising out of, contributed to by, or resulting from any infectious epidemic/pandemic.

General FAQs

Each year, we are asked by many of our clients “How much medical Malpractice Insurance do I need?”

There is no right answer to this question. Given the unpredictability of liability claims, no-one, not even your insurance broker, can confidently assure you that any limit of cover you select is going to be enough for any claim that you might face.

If your proven negligence in rendering professional services leads to your patient’s permanent disability, the claim against you, and legal costs if you defend the matter and lose, could exceed the maximum limit of cover offered under the CFP Broker’s medical malpractice insurance policy of R10 million.

Below are some points to consider when making your decision:

- The limit of cover needs to account for both the legal fees and any settlements awarded to the claimant.

- How much cover can you afford (you need to weigh up your risk vs the cost) – you should always take the highest limit that you can afford.

- Medical Malpractice claims are on the rise in both frequency and cost.

- Imagine a scenario where you were the claimant, and due to the negligence of another professional you are no longer able to work. How much would you claim? Base the quantum on the remaining working years you have (your salary, including inflation, until age 65yrs) as well as any medical expenses you may have during the course of your treatment.

- There are certain activities that would warrant you taking a higher indemnity limit – for example, treating:

- Minors

- High net-worth individuals

- Sport’s personalities or

- celebrities Foreigners

- If you are planning to permanently cease to practice in South Africa (whether through emigration or retirement) you should select the highest option of cover that you can afford as you’ll only be offered run-off cover at the limit you had when you were last practicing.

- Are a practice owner with exposure to public liability and vicarious liability claims.

- Supply products to your patients and are exposed to products’ liability claims.

In insurance – we talk about frequency and severity. We see high frequency of low severity claims against our practitioners and a low frequency of high severity claims. The bulk of the matters we deal with are not for medical malpractice claims, they arise out of complaints to your regulatory bodies, very often where there has been no harm to a patient at all! We have yet to see the Defence Costs for regulatory complaints exceed R1 million.

If your only consideration when determining what an adequate limit of cover would be for you, is that you could cause your patient to suffer permanent disability, then our advice is buy the highest limit of cover that you can afford.

You need to make your own decision with regard to what limit of cover meets your requirements. If you would like a higher limit of cover than R10 million, then you would need to contact CFP Brokers for a quote.

Please notify CFP Brokers immediately as we will need to:

- provide you with comprehensive advice;

- establish how much run-off cover you may be entitled to; and

- place your policy on Run-Off cover at the appropriate time.

If you fail to notify us prior to your ceasing practice your policy would lapse automatically and you would have no further entitlement to cover.

You must maintain your medical malpractice until the end of the policy period in the year that you cease practice. If you work just one day in a year, you will need to keep the cover until 31 December of that same year.

You should not delay notifying us of a potential claim/complaint against you. If someone is making allegations or complaining please contact CFP Brokers as a matter of urgency.

You need to notify any situation which might give rise to a claim in the future as soon as you become aware of it. We have seen claims rejected for two main reasons, namely:

- Failure by the Insured to timeously report incidents which could lead to possible claims or complaints that they were aware of or ought reasonably to have been aware of.

- Failure to comply with policy conditions such as the requirement of signed informed consent.

Do not wait for formal legal action to be taken against you or to receive an official notification from your regulatory body (HPCSA/AHPCSA/SANC), that a complaint has been lodged against you before you notify our insurers of a claim.

We urge you to download and read our document entitled “Incident-reporting and claims’ handling procedures” document for our comprehensive advice.

Medical malpractice cover is a short-term insurance policy. The policy runs for a specified period of time (usually 12 months) and then lapses automatically if not renewed. When you renew a policy, the new policy would only pick up the retroactive [backdated] if there is no gap in cover between the two policies.

The policy that you have in place on the day a claim is made against you or when you become aware of an incident or circumstance which could give rise to a claim or complaint against you – and report it to the insure – (whichever occurs first) is the policy that will apply to cover the claim, regardless of when the services were rendered which have given rise to the claim or potential claim (as long as the services were rendered after the retroactive date).

Due to the nature of claims’ made cover (which is the basis of your cover), you will need to have cover in place:

- At the time that you render the services which give rise to the claim; and

- At the time that you first become aware of the circumstances or incident which could give rise to a claim and notify it through to us in writing; and

- Between a. and b. above, i.e. cover should be continuous and there should be no ‘gaps’ in your cover.

If you do not renew a claims’-made policy or place the policy on run-off and a claim arises after the expiry date, you will have no further entitlement to cover under the policy. This applies even where you had cover at the time the work was undertaken.

The only benefit you would have from the previously lapsed policy is if you had already locked a policy into a claim by notifying your insurers in writing of a potential claim prior to your policy lapsing and they accepted and registered the notification against your policy.

We urge you to download and read our “Notes on the nature of claims’ made cover” for our comprehensive advice.

For many years (all 18 years that we have been the broker for various Associations/Societies), we have not experienced any problems with our Associations/Societies, collecting membership fees from their members and then paying across the premium due in respect of medical malpractice insurance cover for those members under the CFP Brokers Medical Malpractice Scheme Policy. This arrangement has always been supported by the underwriters and insurers that we have placed the cover with.

It has always been the case that only a licenced financial services provider could perform intermediary services, which includes the collection of premiums. We sought advice from our own compliance officer with regard to whether or not our associations collecting membership fees and then paying for cover for their members would be seen to be a contravention of this requirement and our compliance officer advised that it would not be (and they in turn had confirmed this with their own legal advisor who is familiar with the FSCA/FAIS/regulatory requirements). Our compliance officer’s opinion on this matter was supported by the Head of Legal at Hollard. He indicated that as far as Hollard were concerned our Association/Society clients were in no way collecting premiums, they were collecting membership fees and paying across a premium on their members’ behalf, which as a joint-insured, Hollard indicated, the Associations/Societies were entitled to do.

CFP Brokers has been advised that the Financial Sector Conduct Authority (The FSCA) does not accept the payment arrangements that we have had in place in the past decade or more, with regard to our members’ medical malpractice insurance. In order to ensure that your Association/Society is not exposed to regulatory sanction and potential fines from the FSCA (which can be up to R10 million), your Association/Society will no longer be able to pay for this cover on our members’ behalf. You can continue to take out the CFP Brokers Medical Malpractice Scheme cover which you have previously had as part of your membership benefits with your Association/Society but you will be invoiced for your medical malpractice cover directly by CFP Brokers, who are authorised financial services providers, should you elect to continue your cover with us.

It needs to be understood- that under the policy- the insurer is expected to defend you against allegations of negligence, etc. If there is no evidence to support your defence – then you have effectively taken rights away from insurers and created an obligation on them to simply pay what is being claimed. You would have compromised your own defence- and accordingly tied insurer’s or your own hands behind your back. How do you mount a successful defence without evidence? For this reason, underwriters have made it a condition of your cover that you obtain informed consent from your patients, in writing, prior to screening, treatment or the provision of services or products. It would probably be prudent to get patients to sign forms at least annually and if a new condition is being treated then again for the new condition.

Very often, claims may be made years after treatment has been provided and the only possible chance of successfully defending those claims, depends on the records you have made and retained

While a properly signed informed consent form is vital in terms of compliance with policy conditions, it is not the end of the inquiry into informed consent from a legal point of view. Unfortunately, the Law is interested in the proof and not necessarily the Truth. It is therefore vital that you take thorough notes throughout treatment and consider noting consent in the treatment notes in addition to the consent form signed by patients. An alleged truth is of little value without proof when it comes to claims, written informed consent is the best / only way to prove that informed consent was indeed obtained.

Not only would you find yourself without cover under the policy if you did not obtain written informed consent but legal fees (which you would now have to pay for) and risk logically increase with a more complicated defense. There is always risk involved in litigation and a lack of proper informed consent pertaining to the specific treatment increases the risk of an adverse judgment significantly.

Please note that in the event that you notify CFP Brokers of an actual, or potential claim or Regulatory Body Complaint (HPCSA/AHPCSA/SANC) complaint against you, your insurers (iTOO Special Risks (Pty) Ltd for and on behalf of Hollard) will in most cases reject the claim and decline to assist you in instances where you have not obtained written consent forms from your patients and/or their parents/guardians.

One needs to shift the paradigm of informed consent from an initial administrative issue to a vital consideration throughout treatment. When the risks associated with a specific treatment change materially, the informed consent must be revised and reconsidered.

An insurance policy is a contract. Both parties have rights and responsibilities. We therefore urge you to read the various conditions of cover which are found in the Endorsement section of the policy schedule and Conditions section of the policy wording document. Feel free to contact us if you have any questions about the conditions of your cover.

Security, Access and using the CFP MedMal Online System

- If you are on the website page for your specific Medical Malpractice Scheme, please click on the green “Login to your Account” button.

OR

Click here to go directly to the online Medical Malpractice System.

The Login screen “Medical Malpractice Insurance for Healthcare Professionals” will open in a new browser Window/Tab. - Log in to the System by typing in your Email address and Password into the fields on the screen.

- Click the “Sign in” button. (Tip: If your computer auto-populates your email address you must check that there are no extra spaces in front or behind the address otherwise you will receive an error message).

If you have forgotten your password, please follow these steps:

- Navigate to the Login screen “Medical Malpractice Insurance for Healthcare Professionals“.

- Click on the “Lost Your Password” link on the Login screen.

- Enter your email address in the Email field and click on the “Request” button. We will send you an email with an important link which will allow you to create a new password. Please check your Junk or Spam folders in case the email is routed there.

- Click on the link inside the email and follow the on-screen prompts to create a new password for your account. Once you have created your new password successfully, the Login screen will appear

- Enter your email address and your new password in the fields on the Login screen.

- Click the “Sign In” button to access the System.

If you have forgotten your password, please follow these steps:

- Click on this link: Medical Malpractice Insurance for Healthcare Professionals Login screen.

- Click on the “Lost Your Password” link on the Login screen.

- Enter your email address in the Email field and click on the “Request” button. We will send you an email with important instructions to reset (change) your password. The subject line of the email is: “CFP MMOnline – Password Reset Request”. Please check your Junk or Spam folders in case the special email is routed there.

- Click on the link inside the email and you will be taken to the Reset Password screen where you can change your password. After you have created your new password successfully, the Login screen will appear.

- Enter your email address and your NEW password twice. For your security, your password must be at least 10 characters long (including a combination of uppercase AND lowercase letters AND numbers or symbols). Remember to make a note of your new password and keep it safe and/or store it inside your browser for future use.

- Click the “Log In” button to access the MMOnline System.

Due to the complex nature of the underwriter’s forms and tables, we highly recommend that you operate our site using a desktop computer or laptop with a minimum screen resolution of 1240px wide. The wider your computer screen, the better. Small, narrow smartphone screens or tablets do not display correctly all the time.

Also, the best internet browser(s) to use are Chrome, Edge and Firefox released after 01/01/2021. Unfortunately, we cannot guarantee that any other browsers will have the superior functionality that is required by our MedMal System in order to operate efficiently and properly.

If you are trying to create a new profile and you have had cover with CFP Brokers previously, we will already have your details and you will already have a profile on the MMOnline system.

- Click on the green button which reads “Login to your Account” which is found on the right-hand side of the page, towards the top, in the same block as the CFP Broker’s logo.

- Since you already have a profile with us (as you have cover for 2020), you will need to reset the system generated password by clicking on “Lost your Password”. Fill in your email address and click on Request. If your computer auto populates your email address please ensure that there is no space behind the email address otherwise you will receive an error message.

- Our system will send an email to the address you provided. Please follow the prompts in this email to reset your password. Passwords need to be at least 10 characters long including upper-case and lower-case letters as well as numbers.

- Once you reset your password then go back and click on the green button which reads “Login to your Account”. Your email address is your username and insert your newly generated password.

For security reasons you will only have 3 opportunites to insert the correct username and password before being blocked for 4 days.

If our system does not accept your email address, we might have a different email address on our system for you and you will need to contact us to have your email address/username changed.

Payments & Processing

Our MMOnline system does NOT include a payment portal so you can pay the once off annual premium by means of an EFT using your own banking app or internet banking.

You need to apply for cover before making any payment as payment alone will NOT provide you with cover. Once your application has been approved an email containing the invoice will be sent to you. You can also download a copy of the invoice when you login to your profile.

To enable us to ensure that your Insurer receives timeous payment of premium, please:

- Payment must be made within 14 days of our issuing the invoice. Stale invoices will be credited and applications for cover cancelled.

- Use the bank account details and the beneficiary reference reflected on your invoice.

- If you do not use our unique deposit reference your payment may not be receipted and your cover could be compromised as a result. Do NOT add any additional characters or spaces in our unique beneficiary reference as our system will not be able to allocate your payment if you do so.

- Please do NOT send us copies of the proof of payment as you make payment as this only serves to swamp our email addresses and our system should allocate your payment automatically.

- If you pay for your cover and you do NOT receive an automated email confirming receipt of your payment within a week or two of making payment, please send a copy of your proof of payment to Lauren at lauren@cfpbrokers.co.za . Please remember to check in your Junk Folder before you contact us. Please add “Proof of Payment” and your name in the subject line of your email in order for us to prioritise your email.

Note that cover is only in force once payment has been received.

Once your payment is verified (automatically by the MMOnline System if you have used the correct beneficiary reference or manually if the beneficiary is incorrect) you will be able to download your proof of insurance letter and the policy documents.

Depending on the bank you bank with it can take a day or so before the payment clears. In addition, payments do not go into our bank account but go into a Fulcrum / Hollard account so it takes a couple of days before we are notified of a payment. A file then gets sent to our system and payments are automatically allocated. The entire process can take between 4 and 7 days depending on whether a payment fell over a Friday or weekends.

In the event that you do NOT receive an automated email from us acknowledging your payment, please send us a copy of the proof of payment. It would assist us if you state “POP – Manual Allocation Required” in the subject line of your email.

If you are requiring urgent confirmation of insurance, and you cannot wait for a week, you are welcome to send us a copy of the proof of payment in order for us to manually allocate the payment. It would assist us if you state “POP – Manual Allocation Required” in the subject line of your email.

Download your documents

Log in to the online Medical Malpractice System. If you don’t remember how to login, please refer to the FAQ entitled, “How to Log in to the online Medical Malpractice System”.

Please note that you will NOT be able to download invoices or other documents using a cellphone.

- Once you have logged into your profile on our system, select “Insurance and Invoices” under “Navigate your Dashboard”.

- On the lower right of the screen you’ll see your “Billing History”.

- Download the invoice by clicking on the little blue PDF icon.

If your information is incorrect, you can update your profile details by clicking on “Edit Profile” towards the upper left of your screen. Update the information, save and then download the invoice again.

You will find the banking details at the bottom of the invoice.

Please be sure to use the unique beneficiary reference when making payment otherwise your payment will not be receipted correctly and your cover could be compromised as a result. Please do NOT add any additional information to the unique reference.

Please feel free to contact us if you have any questions.

The policy schedule and policy wording document is available to you once you have logged into your profile.

Log in to the online Medical Malpractice System. If you don’t remember how to login, please refer to the FAQ entitled, “How to Log in to the online Medical Malpractice System”.

- Under “Navigate your Dashboard” make sure that “Profile Dashboard” has been selected.

- You may need to scroll down a little to see “Documents” in the lower middle section of the screen.

- You’ll be able to download your latest Policy Schedule and Policy Wording Document by clicking on the appropriate PDF icon.

You can also download previous policy schedules by selecting “Insurance and Invoices” under “Navigate your Dashboard”. See “Insurance History” on the right of the screen and click on the appropriate PDF button for the document that you would like to download.

- Go to https://cover4profs.co.za/malprac/

- Then select the appropriate logo for the cover you enjoy.

- Then “Login To Your Account.

- If you have forgotten your password, you will need to follow the steps below:

- Click on “Login to your Account” and then click on “Lost Your Password”. Your username is your email address. If your computer auto-populates your email address, please ensure that there is no extra space behind your email address.

- You will receive an email which will enable you to generate a password. Please check your Junk Mail Folder if you can’t find the email

- Once you have generated your new password you can go back to https://cover4profs.co.za/malprac/ . Then select the appropriate logo for the cover you enjoy.

- and “Login to your Account”.

- Now click on Account Information which is the third menu option below your profile details.

- You will now see your Insurance History and Billing History in the middle of the page.

- The maroon proof of insurance PDF icon will only be available once our system has automatically allocated your payment.

- Download your proof of insurance letter by selecting the PDF Icon.